Table of Content

Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. This compensation may impact how and where products appear on this site . These offers do not represent all available deposit, investment, loan or credit products.

See our current mortgage rates, low down payment options, and jumbo mortgage loans. Refinance your existing mortgage to lower your monthly payments, pay off your loan sooner, or access cash for a large purchase. Use our home value estimator to estimate the current value of your home. See our current refinance ratesand compare refinance options. Bank mortgage lender and make them an offer they can’t refuse. Lenders prefer to have people opt for automatic payments – so that payments are made on time, all the time.

Home Lending Customer Service

Please make checks or money orders payable to U.S. You could, if you’re not monitoring the inflows and outflows of money in your bank account, overdraw your account. In order to avoid any problems, just keep track of how much you have in your account at all times. Go to usbankhomemortgage.comand choose the link titled Create a username and password.

You could potentially overlook things like errors, interest rate hikes, or other hidden fees. This can be avoided by simply making it a habit to go over your bill. The next step is to select the account you wish to use to make the payment. After tying in your account number and the final four characters of your SSN number, you’ll need to choose Continue.

Online or mobile banking support

If the payment is sent without the coupon attached to your bill, please include your full account number. You can add it to the memo line of your check or write a note. If you'd like your funds allocated a specific way, please include a note to explain where they should go (e.g., monthly payment due, escrow, or principal-only).

You can get this by using an app, by getting your mortgage company to send an alert or reminder by email, or even by using Google calendar. You’ll be able to avoid late payments by doing so. You can make your mortgage payments online simply by logging into your U.S. You can also view a digital statement and manage your account options online. There is no cost if you make the payment using the app, online, via the mail, or in person. But you may be charged a nominal $5 fee if you pay via the telephone.

How To Ask Your Mortgage Lender for a Lower Interest Rate

Reach out to your lender by phone right away, and acknowledge that your payment was submitted past the deadline. Let them know when they can expect payment. They may be willing to delete your late payment data so that your creditworthiness doesn’t suffer. You also have the option of paying your mortgage bill in person at a U.S. You will need to have your loan number to complete this transaction. To find the nearest bank branch, visit locations.usbank.com.

Our affordable lending options, including FHA loans and VA loans, help make homeownership possible. Check out our affordability calculator, and look for homebuyer grants in your area. Visit our mortgage education center for helpful tips and information. And from applying for a loan to managing your mortgage, Chase MyHome has you covered.

Loan Management and services

Gabrielle joined GOBankingRates in 2017 and brings with her a decade of experience in the journalism industry. Before joining the team, she was a staff writer-reporter for People Magazine and People.com. Online, Us Weekly, Patch, Sweety High and Discover Los Angeles, and she has been featured on “Good Morning America” as a celebrity news expert. Payments can be made by mail, by phone, online or in person. Delivery times may vary, especially during peak periods. This listing was ended by the seller because there was an error in the listing.

U.S. Bank offers numerous reminder options such as, among others, email. Choose your mortgage account and then select the Make a payment. Your first order of business is to download the usbank.com app.

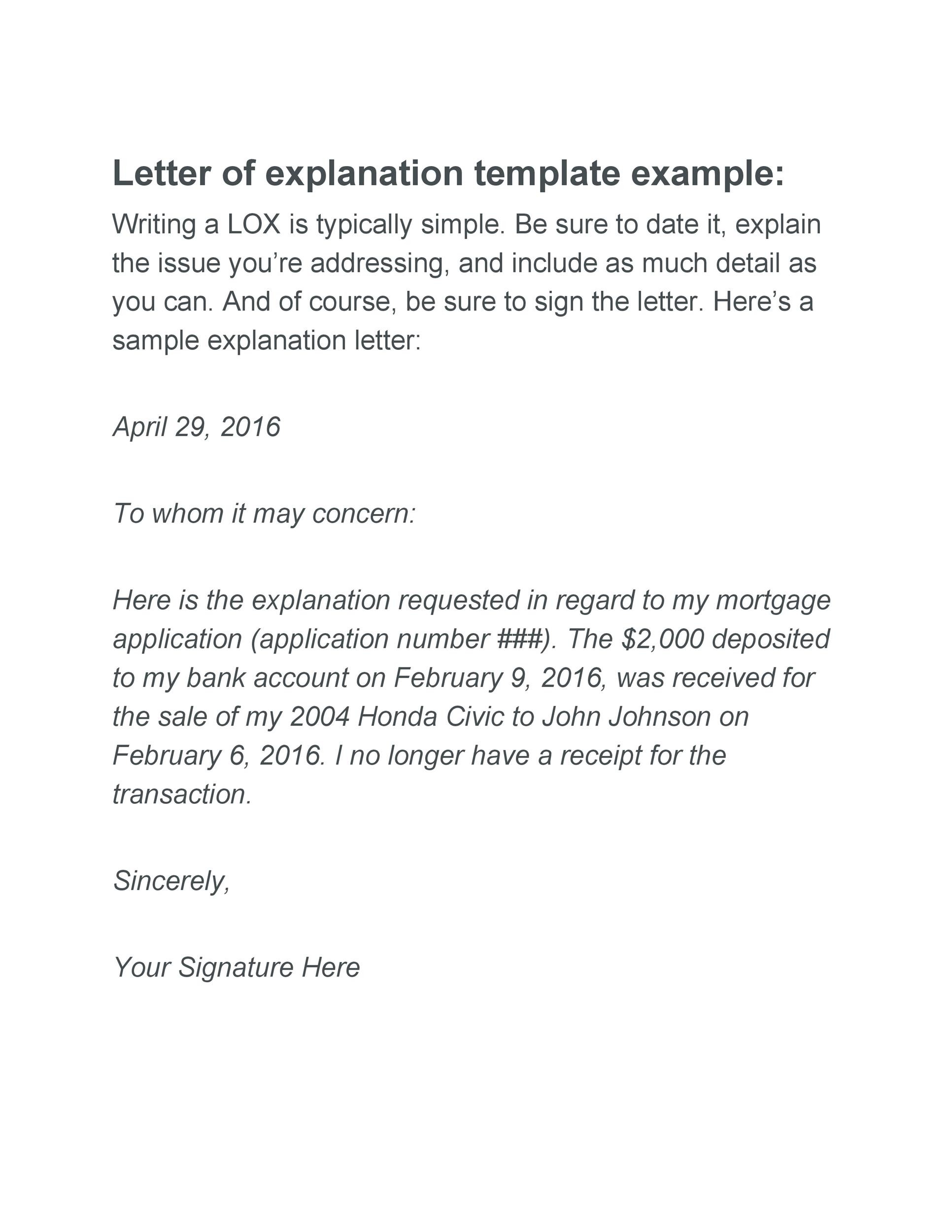

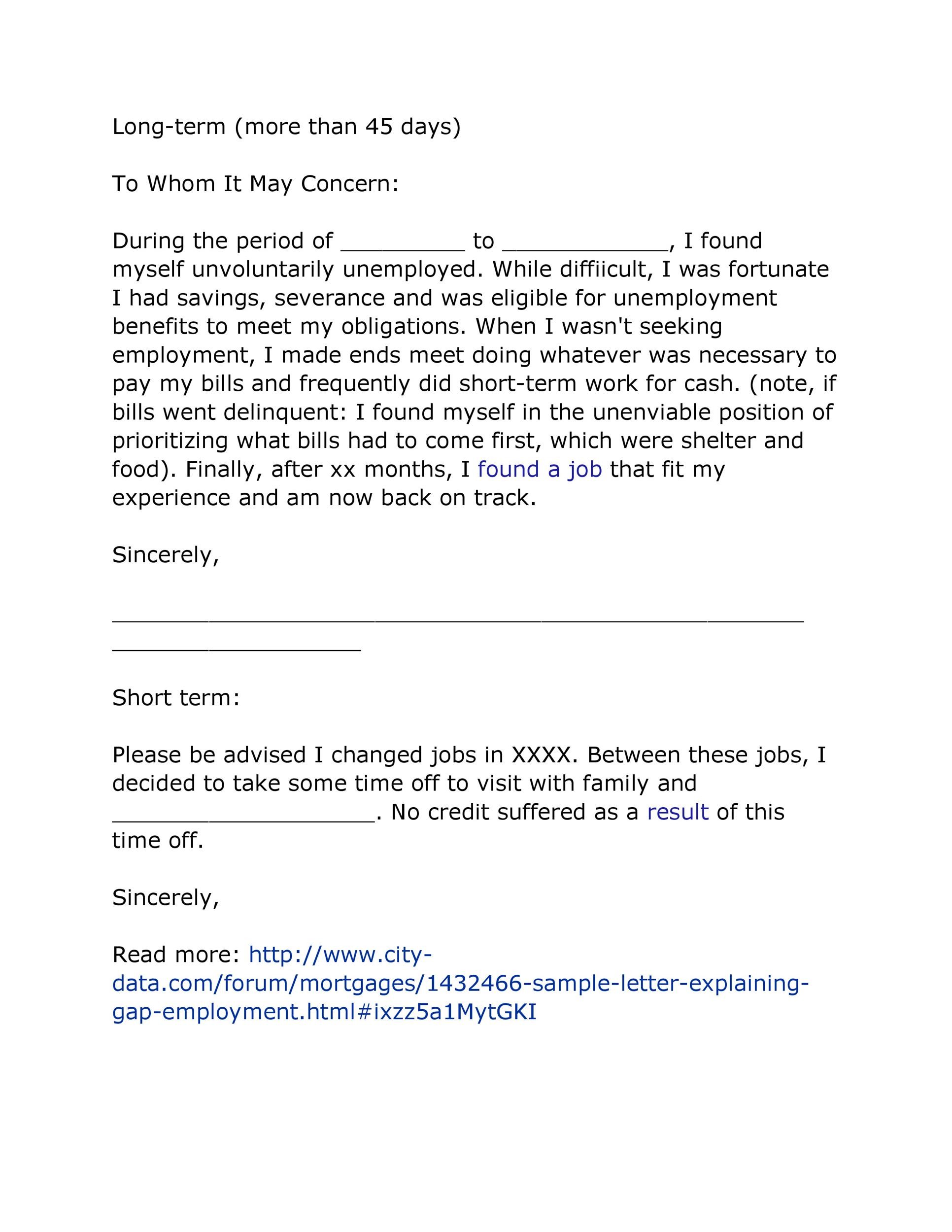

The reason for this correspondence is that I found on my latest credit report a late payment listed on for my account. I’m aware of the importance of making timely payments and meeting my financial commitments. But due to , I unintentionally missed the payment due date. Although I missed the deadline, I have since then taken measures to ensure this does not happen again. Since my missed payment, I have had a flawless record of making payments on time. Receiving a notification for an upcoming bill payment can make all the difference.

For when you need to mail a payment or need the information to set up bill pay with your bank, below is a list of our payment addresses. If you do not send your payment in with a coupon, be sure to include your account number on the Memo section of your check. Chase Bank serves nearly half of U.S. households with a broad range of products. To learn more, visit the Banking Education Center. For questions or concerns, please contact Chase customer service or let us know at Chase complaints and feedback.

Our principal focus and dedication remain on supporting the businesses and economic prosperity of the communities in which we live and work. Poppy Bank is recognized as one of the strongest financial institutions in the country. For a better experience, download the Chase app for your iPhone or Android. Or, go to System Requirements from your laptop or desktop.

You will be charged $11 if you require assistance from a customer service representative to make a mortgage payment. You will save time since auto-pay is convenient. With auto-pay, you can automate the entire process of paying bills. You can avoid late payments and any resulting late fees. This will, in turn, ensure a healthy credit score.